Rating & Bond Information

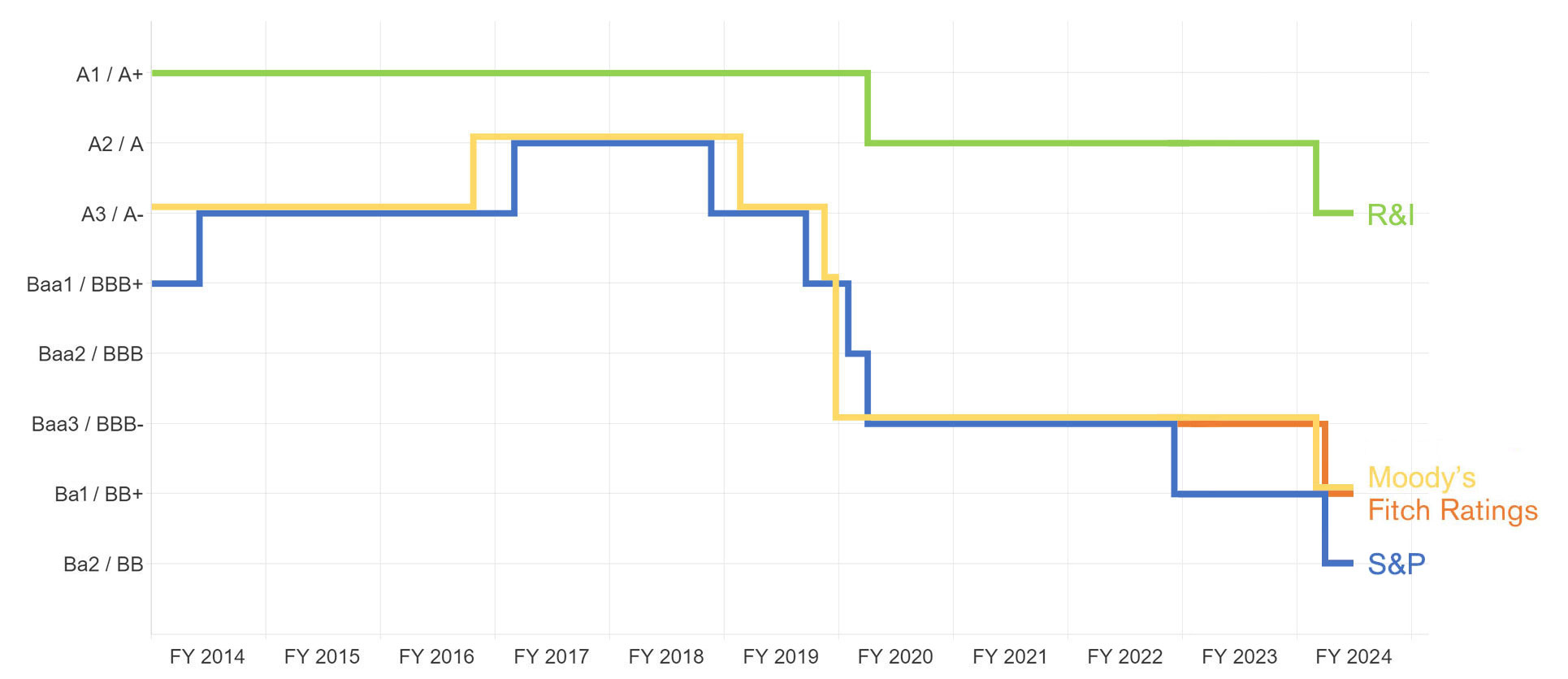

Rating Information

(As of June 6, 2025)

| Long Term Credit Rating | Short Term Credit Rating | |

|---|---|---|

| Moody's Japan(Moody's) | Ba2 | Not Prime |

| Standard & Poor's(S&P) | BB | B |

| Fitch Ratings (Fitch) | BB+ | B |

| Rating and Investment Information, Inc. (R&I) | A- | a-1 |

* For details, please refer to each rating agency.

Bond Information

Outstanding Public Bonds (NML / NFS / NMAC)

Issuer: Nissan Motor Co., Ltd.

Straight Bonds: As of Jun 30, 2025

| Description | Date of Issuance |

Amount (Millions of Yen) |

Interest rate | Maturity |

|---|---|---|---|---|

| 61st unsecured bonds | Apr. 15, 2016 | 20,000 | 0.330% | Mar. 19, 2026 |

| 66th unsecured bonds (Sustainability Bonds) | Feb. 6, 2023 | 140,000 | 1.015% | Jan. 20, 2026 |

| 67th unsecured bonds (Sustainability Bonds) | Jan. 27, 2023 | 50,000 | 1.015% | Jan. 20, 2026 |

| 68th unsecured bonds (Sustainability Bonds) | Jan. 27, 2023 | 10,000 | 1.454% | Jan. 20, 2028 |

| Description | Date of Issuance |

Amount (Millions of USD) |

Interest rate | Maturity |

|---|---|---|---|---|

|

USD-denominated bonds Due 2025 |

Sep.17,2020 | 1,500 | 3.522% | Sep.17, 2025 |

|

USD-denominated bonds Due 2027 |

Sep.17,2020 | 2,500 | 4.345% | Sep.17, 2027 |

|

USD-denominated bonds Due 2030 |

Sep.17,2020 | 2,500 | 4.810% | Sep.17, 2030 |

| Description | Date of Issuance |

Amount (Millions of EUR) |

Interest rate | Maturity |

|---|---|---|---|---|

|

EUR-denominated bonds Due 2026 |

Sep.17,2020 | 750 | 2.652% | Mar.17, 2026 |

|

EUR-denominated bonds Due 2028 |

Sep.17,2020 | 750 | 3.201% | Sep.17, 2028 |

NML Bond Maturity Profile (from Jul 2025 onward)

5/30 TTM 1USD = 144.71JPY

5/30 TTM 1EUR = 165.30JPY

(As of Jun 30, 2025)

(Millions of Yen)

Issuer: Nissan Financial Services (NFS)

Straight Bonds: As of Jun 30, 2025

| Description | Date of Issuance |

Amount (Millions of Yen) |

Interest rate | Maturity |

|---|---|---|---|---|

| 53rd unsecured bonds | Sep. 3, 2021 | 30,000 | 0.580% | Sep. 18, 2026 |

| 55th unsecured bonds | Dec. 3, 2021 | 50,000 | 0.370% | Dec. 18, 2026 |

| 56th unsecured bonds | Jul. 20, 2023 | 40,000 | 0.520% | Jun. 19, 2026 |

| 57th unsecured bonds | Jul. 20, 2023 | 30,000 | 0.834% | Jun. 20, 2028 |

| 58th unsecured bonds | Mar. 6, 2024 | 40,000 | 0.700% | Mar. 19, 2027 |

| 59th unsecured bonds (Green Bond) | Mar. 6, 2024 | 10,000 | 1.033% | Mar. 19, 2029 |

NFS Bond Maturity Profile (from Jul 2025 onward)

(Millions of Yen)

(As of Jun 30, 2025)

Issuer: Nissan Motor Acceptance Company LLC

Global Dollar Bonds under Rule 144A / Regulation S: As of Jun 30, 2025

| Description | Date of Issuance |

Amount (Millions of dollar) |

Interest rate | Maturity |

|---|---|---|---|---|

| US-Medium Term Note | Mar. 9, 2021 | 800 | 2.000% | Mar. 9, 2026 |

| US-Medium Term Note | Mar. 9, 2021 | 600 | 2.750% | Mar. 9, 2028 |

| US-Medium Term Note | Sep. 16, 2021 | 1,000 | 1.850% | Sep. 16, 2026 |

| US-Medium Term Note | Sep. 16, 2021 | 350 | 2.450% | Sep. 15, 2028 |

| US-Medium Term Note | Sep. 15, 2023 | 300 | 6.950% | Sep. 15, 2026 |

| US-Medium Term Note | Sep. 15, 2023 | 700 | 7.050% | Sep. 15, 2028 |

| US-Medium Term Note | Sep. 13, 2024 | 400 | 5.300% | Sep. 13, 2027 |

| US-Medium Term Note | Sep. 13, 2024 | 300 | SOFR+2.05% | Sep. 13, 2027 |

| US-Medium Term Note | Sep. 13, 2024 | 300 | 5.550% | Sep. 13, 2029 |